We Help Businesses Stay On Track

Since 2019, we've been working with Australian organisations to bring clarity and structure to their budget processes. Not through complicated systems, but through practical guidance that actually makes sense.

How We Started (And Why It Matters)

Back in early 2019, a small manufacturing business in regional NSW was facing penalties for budget reporting errors. Not because they were reckless—they just didn't have clear processes. The regulations kept changing, and their internal team couldn't keep up.

That's when our founders decided there had to be a better approach. Most compliance firms talked in jargon and charged like they were doing neurosurgery. But budget compliance isn't rocket science. It's about building systems that prevent problems before they start.

We built inhelooulara around that idea. Plain language. Proactive planning. Real support when you need it, not just during crisis moments.

What Sets Our Work Apart

We've learned a lot working with businesses across different sectors. Here's what actually makes a difference when it comes to budget compliance.

Early Warning Systems

Most compliance issues show warning signs weeks before they become serious. We help you spot those patterns and address them while they're still manageable.

Documentation That Works

Your records need to tell a clear story when auditors come calling. We structure documentation so it's actually useful, not just boxes ticked on a form.

Team Training

Compliance works best when everyone understands their role. We train your staff on the specific processes that matter for your business, without drowning them in theory.

Our Journey Since 2019

Foundation Year

Started with three clients in Tamworth, focusing exclusively on manufacturing sector compliance. Spent most of that year learning what businesses actually needed versus what consultants typically offered.

Regional Expansion

Opened support for businesses across rural NSW. This taught us how to work effectively with remote clients—something that became invaluable during uncertain times.

Sector Diversification

Extended services beyond manufacturing into retail, hospitality, and professional services. Each sector brought unique compliance challenges that strengthened our overall approach.

Current Focus

Working with over 70 Australian businesses. Our emphasis has shifted toward preventive systems that catch issues early, reducing the stress and cost of reactive fixes.

The People Behind The Work

Budget compliance requires both technical knowledge and practical judgement. Our team brings experience from accounting firms, regulatory bodies, and years of working directly with business operations.

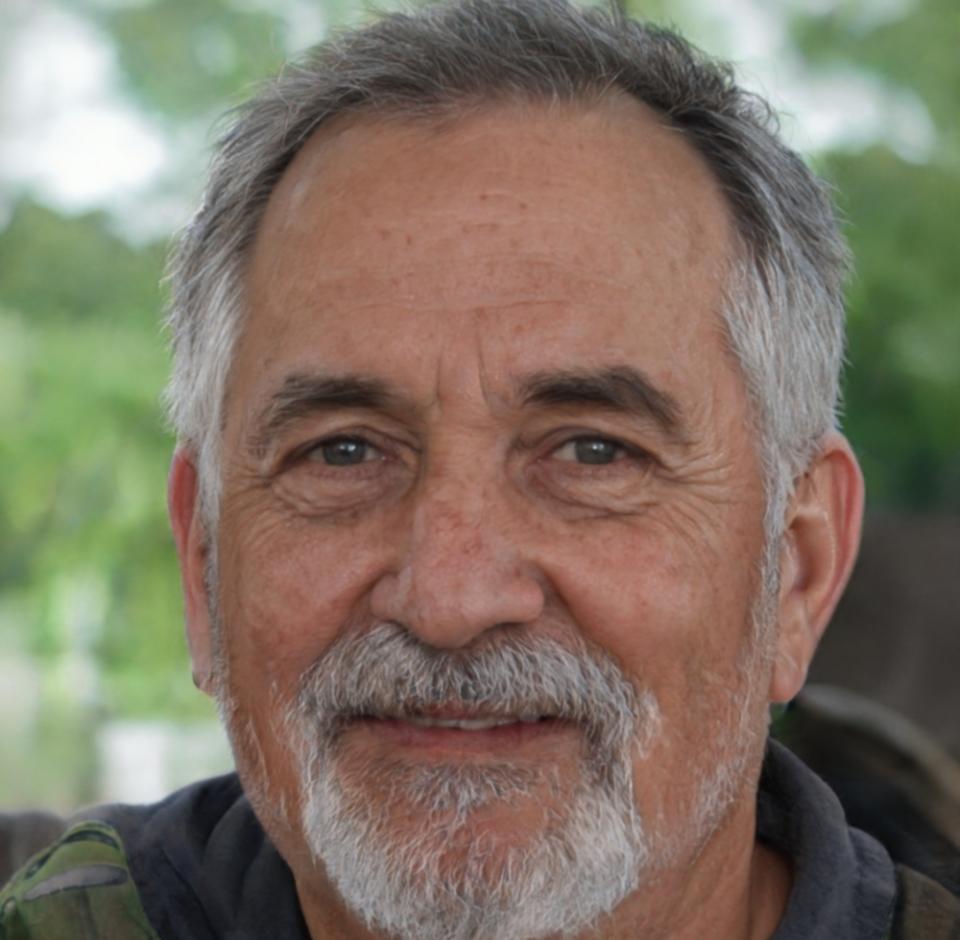

Harlow Fitzpatrick

Financial Compliance DirectorSpent 12 years at mid-tier accounting firms before joining inhelooulara in 2020. Harlow specialises in translating dense regulatory requirements into practical action steps for non-finance teams.

Stellan Oakes

Budget Strategy LeadFormer auditor who understands what regulators actually look for during reviews. Stellan helps clients build documentation systems that hold up under scrutiny while remaining manageable day-to-day.